Dear Readers,

Welcome to another edition of Bargain Stocks Radar.

For this issue I thought I would share you with my research notes on a Hong Kong listed smid cap called 361 Degrees International Ltd.

The share price has increased by around 20% since I started researching. Despite this increase the shares still look undervalued.

Please note: this article should act as an introduction the company and is not a complete deep dive. Make sure you do your own research before investing in any company mentioned in this newsletter.

Table of contents:

361 Degrees International -

Company Overview

Business Model

Competition

Competitive Advantages

Growth Opportunities

Financials

Management

Risks

Valuation

Conclusion361 Degrees International Ltd. (1361) 🇭🇰

361 Degrees is a Xiamen (China) based sportswear firm established in 2003 and listed on the Hong Kong Stock Exchange in 2009. The current market cap at time of publishing is 11.31 billion Hong Kong dollars ($1.44 billion USD).

The company designs, manufactures and distributes their own branded athletic footwear, apparel and accessories.

The business is organised into two segments – an adults segment and a kids segment. Adults’ footwear and apparel remain core, but children’s shoes/apparel now contribute roughly one-fifth of revenue.

The company sells via a network of distributors, e‑commerce and over 10,000 outlets through-out China. Although mainly domestically-focused, 361 has begun expanding internationally.

You can easily find their products being sold on popular ecommerce websites around the world such as Shopee, Lazada, Temu, Amazon etc. The reviews seem very positive too.

Earlier this year also saw them open the first Malaysian flagship store (AEON Bukit Tinggi, Klang) as part of their expansion into South East Asia.

Business Model

361 is vertically integrated, they design and manufacture most of their own products and also source from external suppliers as needed. They employ a multi-channel approach, selling to traditional retail stores, branded 361 outlets run by authorised dealers, apparel distributors, and e-commerce third parties.

E-commerce is increasingly important – accounting for about 26% of 2024 revenue – and management sees its online channel as the main strategic focus.

361 positions itself as a value-for-money - offering products at lower price points than competitor brands, and targeting consumers in China’s third and fourth-tier cities.

They operate through a franchise-like model by partnering with authorised dealers rather than directly managing their own retail stores.

These independent dealers are granted the right to operate branded 361 outlets across China, handling retail operations such as staffing, lease management, and local marketing.

While the model resembles a traditional franchise (dealers use the 361 brand, store format, signage, and marketing materials, and must adhere to company guidelines on layout, merchandising, and pricing) it differs in a few key ways.

Notably, 361 does not earn revenue from franchise fees or royalties; instead, its income comes from selling products to the dealers, making it more of a wholesale relationship with embedded branding rights.

This approach minimises the company’s capital investment and operational risks. As of 2024, approximately 5,740 branded stores were operated by these dealers, with about 75% located in China’s 3rd and 4th tier cities.

The majority of the authorised dealers prepay for orders. This payment model diminishes working capital risk, supports leaner cash management, and protects the company from excessive exposure to underperforming dealers.

Competition

Major Chinese peers such as ANTA Sports, Li Ning and Xtep (all public companies listed in Hong Kong) plus global giants Nike and Adidas dominate China’s sportswear market.

While 361 trails these market leaders in scale, they have impressively carved out a niche in lower-tier cities. Their focus on affordable pricing has made it popular among cost-conscious consumers.

At present their market share may be modest but their sales momentum often outpaces bigger rivals. This quarter 361 achieved 10% revenue growth versus low single-digit growth for Li Ning and Anta.

In an extremely competitive industry 361 seems to be holding their own.

Competitive Advantages

While there is no clear moat, 361’s strengths centre on value pricing and distribution in underserved markets. Its products undercut premium brands, which resonates amid China’s recent “consumption downgrade” trend.

Management highlights competitive pricing, healthy inventory turnover and ample cash flow as enabling 361 to outgrow peers.

The company’s heavy focus on third and fourth tier cities gives them an edge where rivals have less penetration. Their extensive store network and increasingly online sales provide broad reach.

The marketing/advertising strategy seems to be working well. 361 has high-profile endorsements and sports partnerships in place that have helped boost the brands image.

They were the official apparel provider for Chinese curling at the 2010 Winter Olympics and for Olympics volunteer staff in Rio 2016. They later sponsored the 2022 Asian Games.

More impressively in late 2023, NBA star Nikola Jokic signed on as a global brand ambassador. Basketball is very popular in China, so bringing on board Jokic was a landmark endorsement for the brand. As a major push is its basketball line in December 2024, 361 launched Nikola Jokic’s debut signature shoe (the JOKER 1) in the USA and planned releases in Europe and China.

The company intends to follow with a full range of Jokić-branded footwear and apparel, leveraging the NBA star’s global profile.

Whilst perhaps not a competitive advantage these sports partnerships have been a key part of their marketing strategy and subsequent growth that helps differentiate the 361 brand from competitors.

Growth Plans

As previously mentioned the company is expanding domestically and abroad. Management is aiming to open more premium stores in smaller Chinese cities, and grow the kids’ side of the business. The CCP have done a full u-turn on their one child policy. If this, along with other policies, help families have more kids it will of course be a tailwind for kids apparel.

Internationally, 361 is accelerating expansion into Southeast Asia, Europe and North America. In January 2025 they opened the first Malaysian store and have laid plans for multiple outlets in the Klang Valley.

Currently, they have established 1,365 offline points-of-sale in overseas markets covering regions such as the Americas, Europe, and regions alongside the Belt and Road Initiative.

At the same time, the overseas e-commerce platform also went live, marking a pivotal step towards the integrated development of online and offline operations in overseas markets. They can now sell through their own websites as well as via third parties such as Shopee. This should help improve margins.

Financial Performance

361 has delivered strong growth over the past few years.

In FY 2024 revenue reached 10.07 billion RMB, up 19.6% from 2023, and profit rose 19.5% to 1.15 billion RMB.

Operating margins hover around 15-16%, and returns on capital employed around 14%.

The balance sheet remains healthy with modest debt of $264 million HKD, and plenty of cash. The company has grown organically with out any need to take on large amounts of debt or by issuing new shares.

Management

361 is a family business, led by the Ding family who own a combined 49% of the shares. Huihuang Ding (59) serves as Executive Chairman and Wuhao Ding (59) is the President & Executive Director.

Management compensation seems largely cash-based with a standard salary with performance bonuses. In 2024 Huihuang received $1.31 million HKD , and Wuhao $1.54 million HKD in total payments. This aligns well with shareholders, as most of their wealth will come from the growth of the business and dividend payments.

Risks

Key risks include the intense never ending competition and the pricing pressure this brings. There are regular price wars in China to gain market share.

As many may know the Chinese economy is not doing so well compared to previous years. A further downturn in the economy or consumer spending would hurt all discretionary goods. The focus on lower-tier cities also means exposure to local economic swings and demographic trends. International expansion will diversify the revenue mix.

However, international expansion does bring its own set of risks. Building brand recognition in overseas markets (even with NBA tie‑ins) is challenging and requires significant marketing investment.

Finally, as a Hong Kong–listed, family‑led company, 361's governance and major‑shareholder dynamics may concern some investors (for example, future leadership succession or shareholder liquidity).

Valuation

On the 14th July the company issued a statement saying retail sales grew by 10% for the first quarter of 2025, which bodes well for the year. The stock currently trades on a P/E of 7, which is much lower than peers.

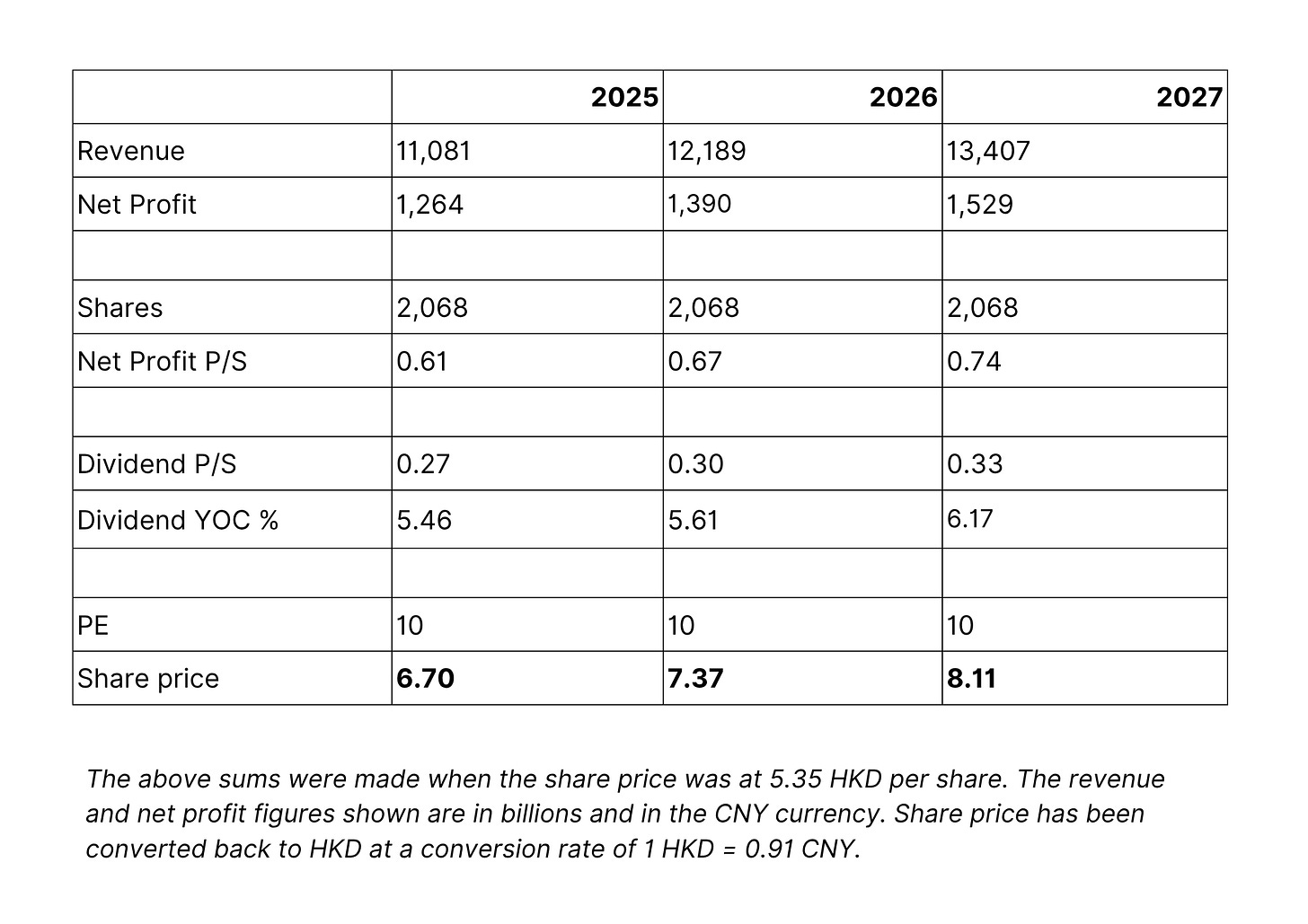

If 361 can grow revenue and net profit by 10% per year through to 2027, while maintaining current operating margins, and the P/E multiple is re-rated to 10, then we could get to a share price of just over HK$8.

This would represent an upside of near 50% from the current share price. If the company can achieve a higher growth rate and a multiple re-rating to 12 then we will obviously see an even higher share price.

For dividends the company targets a payout ratio of around 45% of net profits. This would provide a dividend yield-on-cost of around 6% by 2027, which is not bad for income seekers and dividend growth investors.

These are just rough ‘back-of-the-envelope’ calculations. As per usual I will leave it to readers to plug in their own estimates and conduct a deeper analysis of potential valuation.

The table below shows the current valuations competitors are trading on.

Conclusion

Overall 361 seems like a well-managed business that’s trading at a significant discount to peers and pays a nice dividend. The international expansion opens up the opportunity for continued growth in revenue and profits. With more liquidity being directed into Hong Kong stocks I feel 361 Degrees is flying ‘under-the-radar’ and could be worthy of further attention.

Thanks for reading. Let me know if you’ve found any other decent cheap stocks that we should be looking at.

Please note the information in this report is for informational purposes only and should not be seen as investment advice. Please do your own due diligence before investing in any company mentioned in this article.